Residents in Bellevue will see property tax rate and assessed value decrease in 2023.

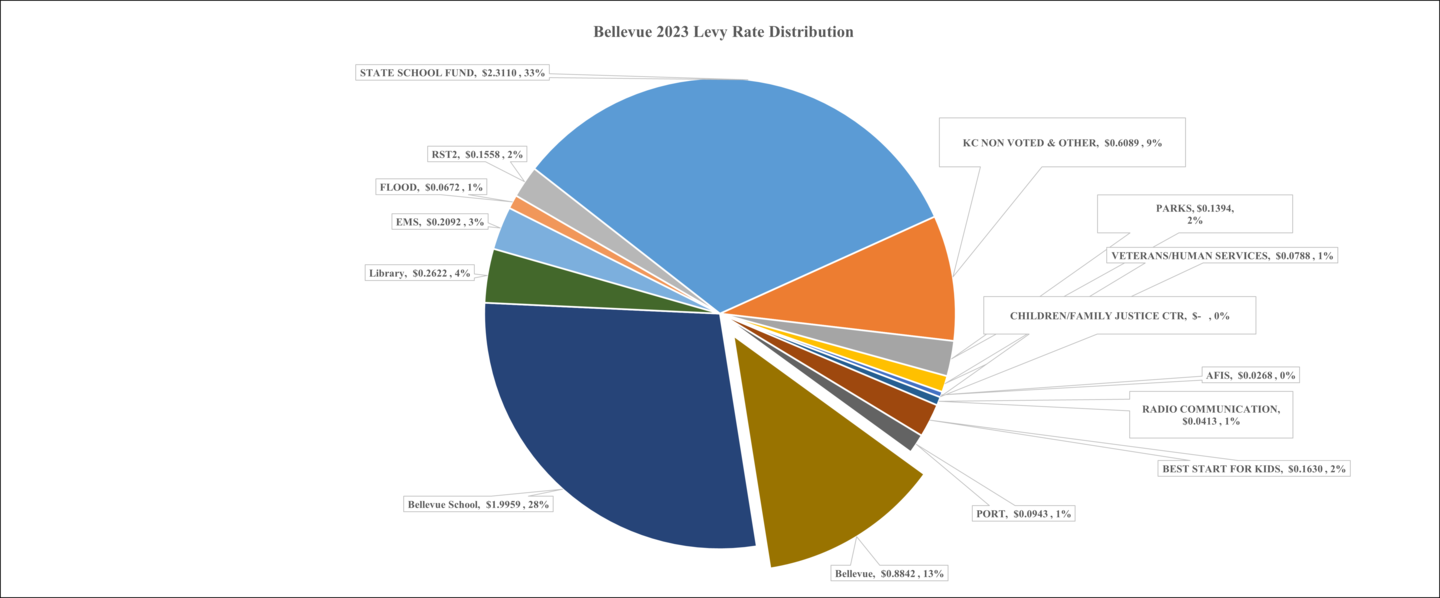

Where does the money go? The most common property tax rate in Bellevue is $7.10 per $1,000 of assessed value with 88 cents of that $7.10 going to the City of Bellevue. In contrast, the 2022 common rate was $8.20 per $1,000.

Using this rate and a Bellevue house valued at $1 million as an example, the total annual tax from 2022 to 2023 will decrease by about $1,100 due to the decrease in rate. The 2023 total property tax for a $1 million Bellevue home is $7,100, approximately 10%, or $710 is returned to the city. The remaining 90% goes to many other jurisdictions. You can find a complete breakdown by clicking on the pie chart below.

Click on chart for full-size version